Are You Ready For The Future?

Whether you are a startup, a small to medium-sized enterprise, an international network of subsidiaries, or a government agency, our flexible end-to-end solutions for BUSINESS, CLOUD, ANALYTICS, and DIGITAL TRANSFORMATION provide you with the freedom and control you need to thrive!

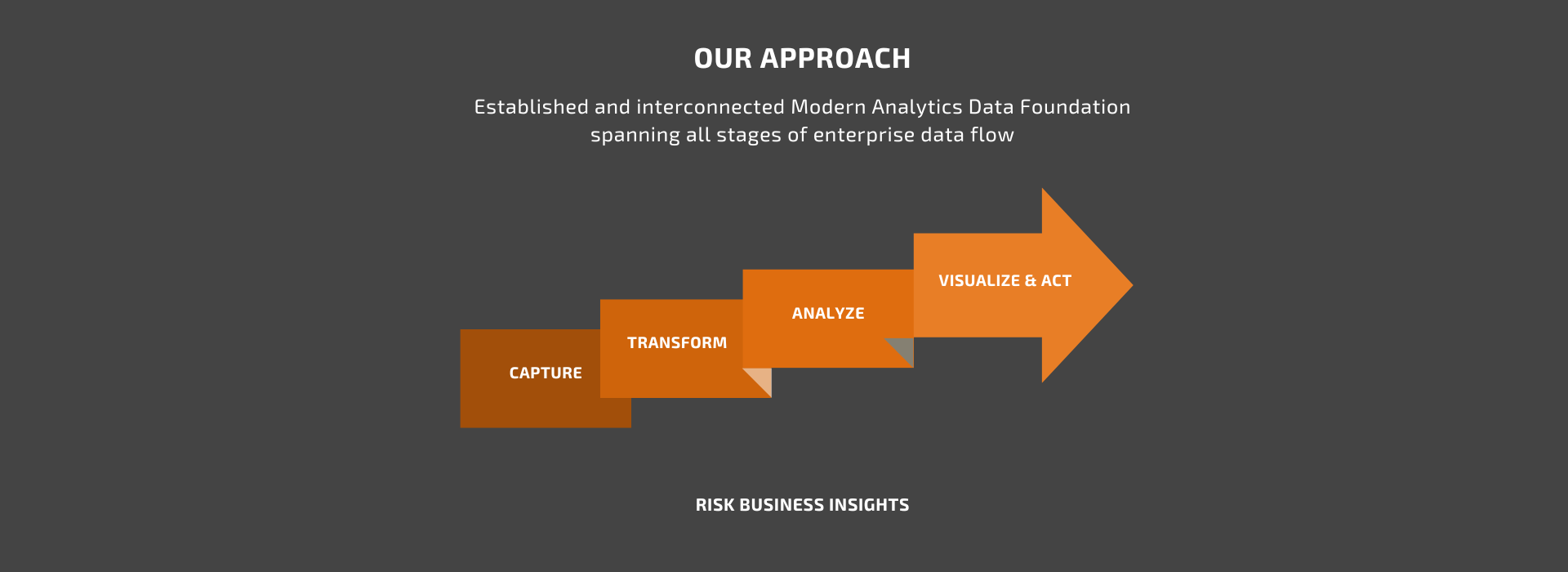

Unlock the true potential of your data with Totago Technologies. Our expertise lies in unifying all your enterprise data sources, providing a comprehensive view of customer behavior. By seamlessly integrating diverse data sets, we not only mitigate risks and reduce complexity but also empower you with real-time insights, ensuring a holistic understanding of your business dynamics.

OUR SERVICES

STRATEGY

Developing a meaningful Business Intelligence and Analytic Solution goes beyond having the right tools or technology—it depends on having the right strategy.

At TotaGo Technologies, we offer a comprehensive range of services to support you in every aspect of a Business Intelligence, Data, AI, and Analytics initiative. From assessments and strategic roadmaps to overseeing successful DW/BI system implementation.

IMPLEMENTATION

We offer a comprehensive suite of business intelligence and analytic implementation services, encompassing Project Management, Data Warehousing/Data Lake, Data Integration, Data Archiving, Data Quality, Data Monetization, On-Premises and Cloud BI/Analytic system design and architecture, Reporting and Advanced Analytics (AI & Machine Learning), Visualization, Tool Upgrade and Migration, Mobile Business Intelligence, Training, Education, and more.

MAINTENANCE

Sustaining business value is achieved by delivering superior support, encompassing the deployment of new requirements, bug fixes, and general incident management.

This phase marks the culmination of previous iterations in the Strategy, and Implementation phases, defining our overall engagement

strategies. It spans Support, Service Management, and Governance.

SATISFIED CUSTOMERS